Give Your Clients Something New to Talk About

Changing habits — especially client habits — is difficult.

But it’s easy to just continue down a familiar path, maybe renewing the same one- or five-year CD continuously, instead of speaking to them about other options.

There are currently $27 trillion in assets sitting on the sidelines.

Some of your clients may also have CDs renewing in the next 30 days. This is a great chance to capture some assets held away.

You owe it to your clients to bring up the possibility of other solutions. And we’ve got a simple way to help you do it.

Make a simple illustration

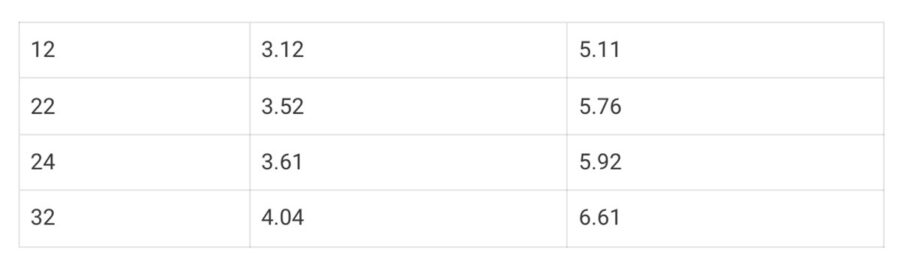

I want you to make a box with four different rows and three different columns.

- In the left-hand column, write 12, 22, 24 and 32.

- In the middle column, write 3.12, 3.52, 3.61 and 4.04.

- And in the far right-hand column, write 5.11, 5.76, 5.92 and 6.61.

Before I tell you how to title the chart, can you guess what you’ve created?

- The left-hand side is the client’s tax bracket

- The middle column is the taxable equivalent yield on a multi-year guaranteed annuity at 2.75%

- The right-hand column shows fixed indexed annuities that average about 4.5%

The result shows fixed indexed annuities work

And you can see that that the left-hand column is significantly higher than many other safe alternatives, such as bank CDS and bank money market accounts.

Certainly, annuities have some risks, such as the sales charges and then the risk of the carrier.

But at the end of the day, there are substantial differences in rates of return for clients in today’s low-interest-rate environment.

So, I encourage you to take the first step and show your next client the chart you created.

Find out if there are other assets that you’re not aware of and that you might be able to capture using protected income. Your Ash team can help. Call us for more about how annuities can fit into your client’s retirement plan.

Don’t fall into the pattern of mindlessly renewing CDs. Use a simple illustration to demonstrate for your clients how annuities can add value to their retirement income.