Injury and illness don’t care who you are – your wealthiest clients income could be brought down in an instant. Disability insurance lets families keep their houses. It keeps businesses open. It allows plans to stay in motion. When you want the best in DI knowledge, passion and experience, trust Ash.

It’s our job to make sure that everything works when your clients can’t. Let us show you how whatever the question, whatever the need, Ash Answers.

For business owners, a disability could mean the end of everything they’ve worked to create. You can provide critical protection while creating opportunities and setting yourself apart from the competition.

You went above and beyond. After receiving the quotes that I requested, I responded back via email with questions and the case designer called me to explain. She was on the phone with me for a while as I continued to ask questions and did a great job explaining the benefits. I am looking forward to selling more policies with the Ash team!

There are a lot of factors involved with each opportunity, and because of the complexity, DI quotes can’t be run online. Don’t worry – we’ll design a plan tailored to your client, then give you the product-specific ideas and point-of-sale expertise to help secure the deal. Once the app is submitted, our dedicated DI case managers will make the underwriting process as simple as possible.

If you have a client considering disability insurance, contact us

You’re ready for a partnership that provides individualized support and a commitment to work with you the way you want. See how we work together.

Here are some of the most common questions we get asked about long-term care. For additional questions, check out our FAQ page.

There are a lot of factors involved with each opportunity, and because of the complexity, DI quotes can’t be run online. We’ll create an illustration tailored to your client, then give you the product-specific ideas and sales support to help secure the deal. You can start by giving us a call or filling out a quote request form.

The process of determining if your client will qualify for disability insurance is called underwriting. Underwriting for DI is different than life insurance underwriting, since DI coverage protects against the risk of morbidity, while life insurance uses mortality data to assess the likelihood of death.

Disability insurance carriers exclude certain occupations from coverage, but eligibility is primarily based on the information you can provide about your client. This process is called field underwriting — your initial data gathering before any quotes are run. The more our team knows, the better we can determine if your client will qualify. Some key factors include:

- Occupation with specific daily duties

- Date of birth, height and weight

- State of residence

- Tobacco user status

- Any medical issues, including back or heart trouble, sleep apnea, stress, anxiety, depression, etc.

- Income/business information

- Employees: W2 income

- Business Owner: Net taxable reportable income, how long they have owned the business and how many employees they have

If you need help asking the right questions, our DI Quote Request form is a good place to start, or you can call our team to talk through your client’s eligibility.

This is a critical aspect for DI underwriting. For W2 you'll need last year’s W2 and a recent pay stub. For business owners, you'll need the last two years of tax returns with all schedules. We'll serve as your client’s advocate with insurance company underwriters.

Ash Brokerage has a range of solutions available to meet your clients’ needs. Our carriers have white-collar, middle America or special/impaired risk focuses:

- For white collar, Petersen International, Principal and The Standard

- For middle America, Assurity, Illinois Mutual and Mutual of Omaha

- For blue collar, Assurity, Fidelity and Petersen International

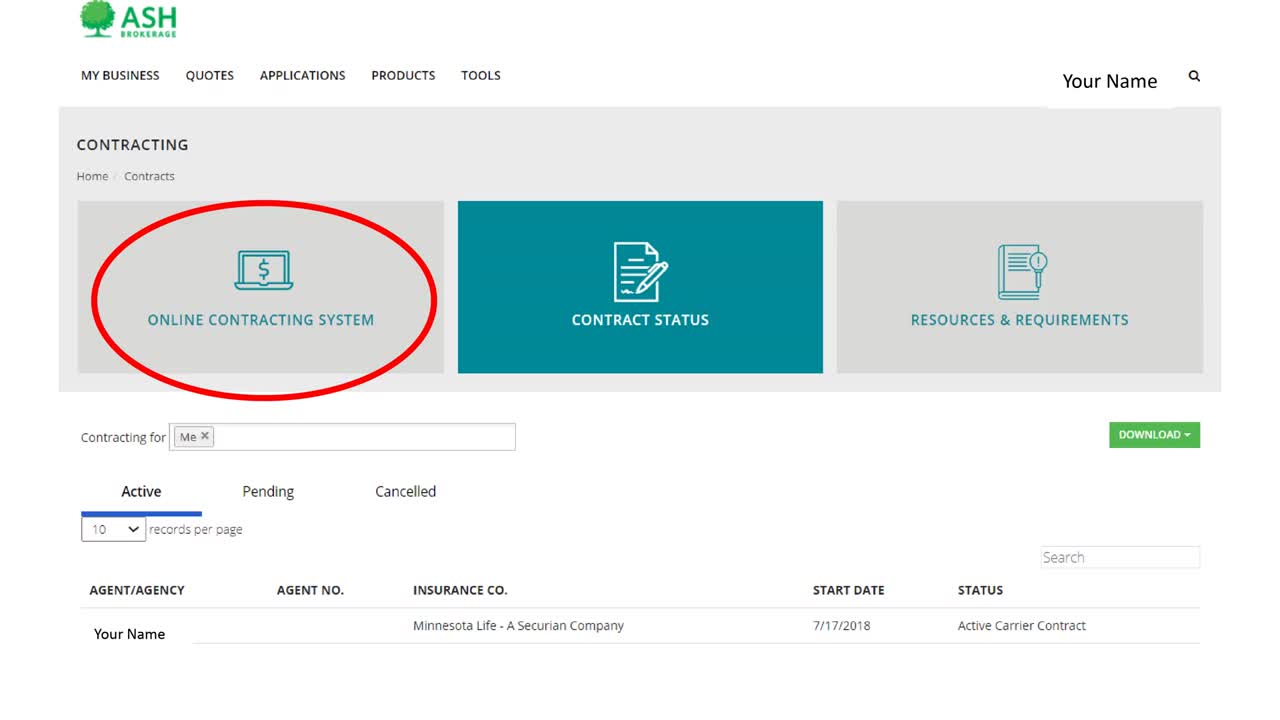

Everything is done online through an electronic contracting system called SureLC. You'll want to log in to the Advisor Portal. From the homepage, click on the Contracting tile, then choose Online Contracting.

For the initial setup, your information pulls directly from the National Insurance Producer Registry – it may be as easy as verifying no changes are needed or completing your profile that includes submitting your signature card, Errors and Omission coverage, AML, and if directly paid, direct deposit information.

After setting up your initial profile with our online contracting system, you can request additional insurance carrier contracts at the click of a button. You can also update any contracting documents such as AML, E&O, or bank information. No more unnecessary duplication of efforts, redundant questions or searching for up-to-date paperwork. It’s fast, paper-free, and it’s always available when you need it.

If you need help, our Commissions and Contracting team is available to make sure the insurance process never stands in the way of progress.