Life Insurance

For term life insurance quotes, we recommend you use our Ash Term Express platform. You'll achieve higher placement rates and get policies issued quickly – all in one simple tool.

Available by logging on to the Advisor Portal, Ash Term Express takes the guesswork out of the quoting process. Using insights about health guidelines and accelerated underwriting options, you can easily identify the best match in every situation. And, you can save your quotes for quick retrieval when it's time to start an application.

If you need assistance finding or using the tool, please contact us.

The easiest way is to call the Life Marketing team so we can talk through your client's unique goals and considerations. You can also log in to the Advisor Portal and run an initial quote through iPipeline.

For complex cases, you may want to start by gathering your client's health information using our Life PreView tool. Or you can complete a traditional quote request form to gather the information we'll need to prepare a custom illustration.

Some advisors also like to see the specific life insurance product guide or policy and procedure manual for the carriers they will be applying to. Our Life Marketing team can help get the current materials from our insurance carrier partners.

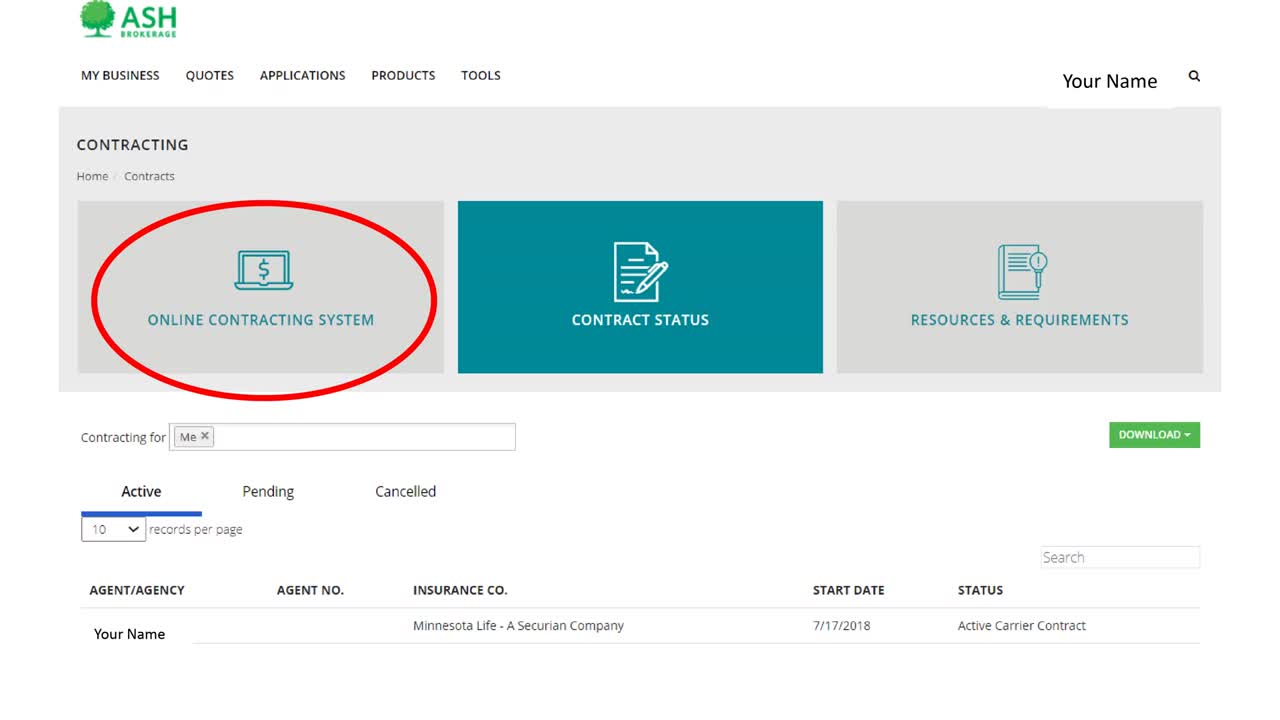

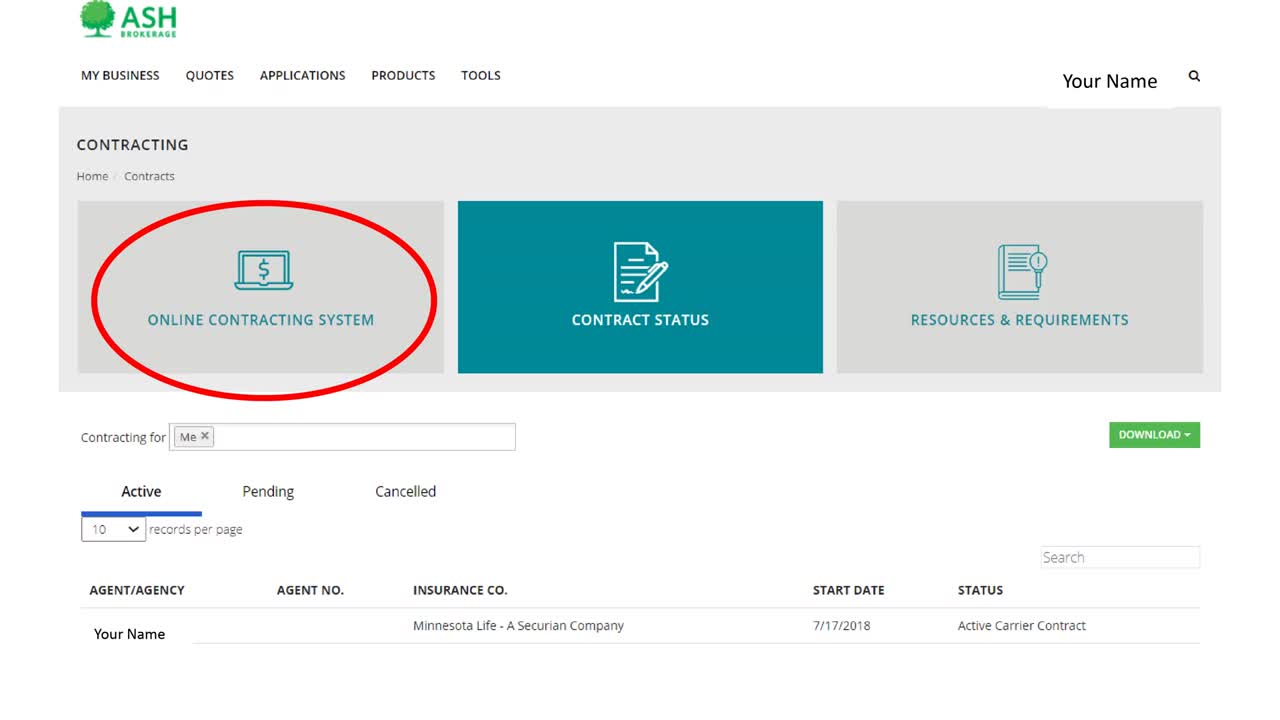

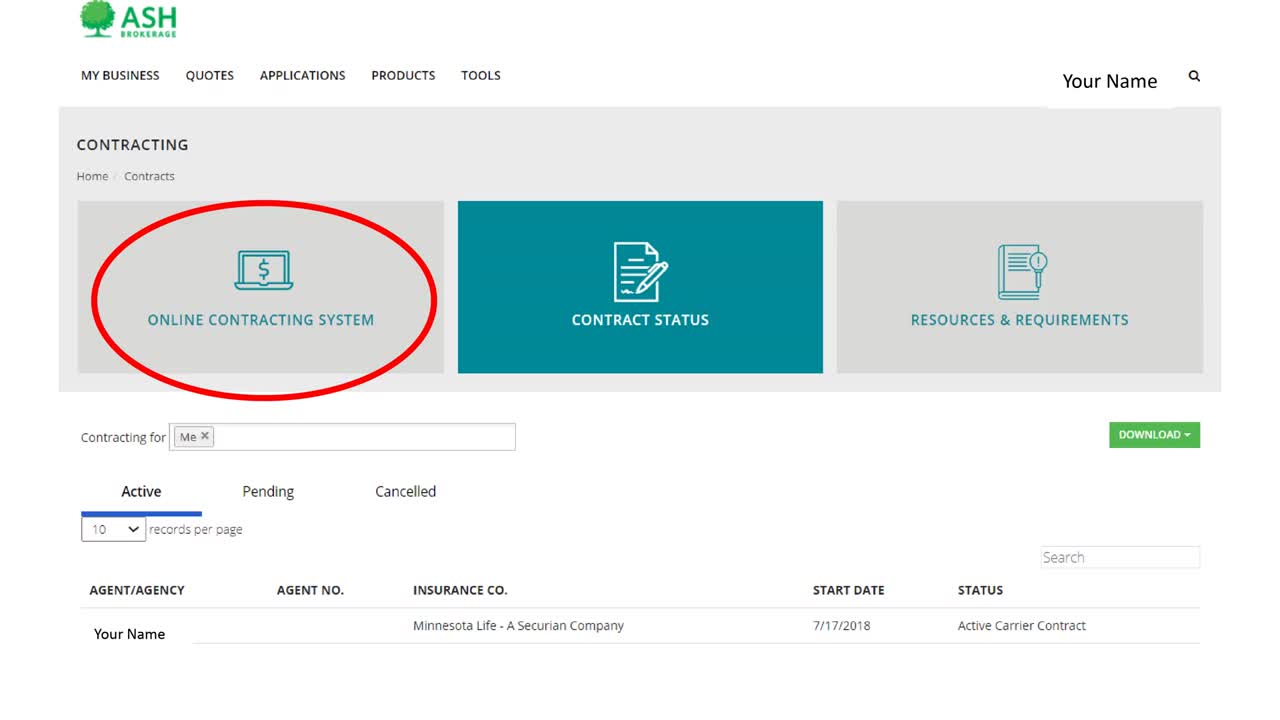

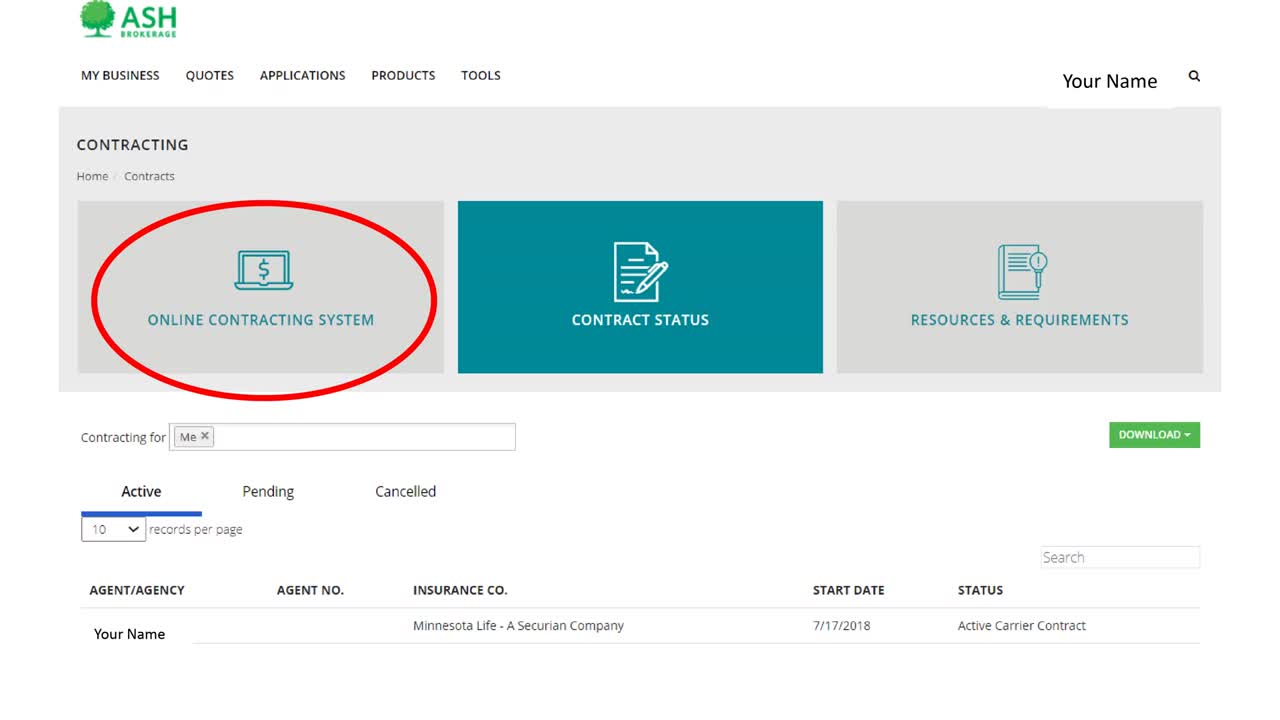

Everything is done online through an electronic contracting system called SureLC. You'll want to log in to the Advisor Portal. From the homepage, click on the Contracting tile, then choose Online Contracting.

For the initial setup, your information pulls directly from the National Insurance Producer Registry – it may be as easy as verifying no changes are needed or completing your profile that includes submitting your signature card, Errors and Omission coverage, AML, and if directly paid, direct deposit information.

After setting up your initial profile with our online contracting system, you can request additional insurance carrier contracts at the click of a button. You can also update any contracting documents such as AML, E&O, or bank information. No more unnecessary duplication of efforts, redundant questions or searching for up-to-date paperwork. It’s fast, paper-free, and it’s always available when you need it.

If you need help, our Commissions and Contracting team is available to make sure the insurance process never stands in the way of progress.

Evidence shows that approval and placement rates are higher with accelerated underwriting (AU). On average, AU cuts the processing time by three weeks. It’s faster and more convenient for you and your client because underwriting is completed based on data, instead of on labs and medical records. And it means less time for clients to change their minds and decline coverage.

But with traditional quoting software, it can be hard to determine which carrier's accelerated underwriting is best for your client, or if they will qualify. With Ash Term Express, we’ve filtered through all carriers’ constantly changing AU programs to bring you the best fluidless underwriting programs. The platform intuitively understands which carrier’s AU process is best for your client, providing an AU score for each program. The AU score is based on AU policy limits, probability of approval as applied for, and average time to place an AU policy.

Most of our insurance carriers provide manuals for their underwriting guidelines. The full guidelines can be found by accessing the Ash Advisor Portal. Scroll to the bottom of the page and choose "Carrier Guidelines" from the Underwriting menu.

Our team also prepares numerous "cheat sheets" — for impairments, family history, build, blood pressure, tobacco use, motor vehicle records (MVR) and more — where each carrier's underwriting requirements can be viewed and compared at a glance.

But you don't have to go it alone! Reach out to the case management team for help with specific client questions!

An application for all of Ash’s carriers can be submitted through Ash Term Express.

Our top 20 life insurance carriers will be available to you in the Ash Quoter within the Ash Term Express platform. The platform will ask upfront questions to surface the best solutions for the client.

For New York clients only. All carriers can be quoted on the Ash Term Express platform. Ash Term Express applications for three NY carriers (AIG, Prudential and William Penn) with accelerated underwriting is available, if your client qualifies.

A 1035 exchange is the exchange of an insurance contract for another that meets all the requirements of Section 1035 of the Internal Revenue Code (IRC 1035). When a contract is exchanged under IRC 1035, the gain or loss of the exchanged contract is transferred to the new contract. Requirements for non-taxable treatment include:

- The owner and the insured/annuitant on both contracts must be identical

- The contract being exchanged must be in force. If the contract is maturing, the 1035 exchange must be signed prior to the maturity date

The Ash Rating inside Ash Express is a combination of price, underwriting performance and probability of client success.

This was previously the Ash Score. Now, with a simple star rating, you’ll be able to tell at a glance how the different products and carrier scores compare and choose the quote that best sets up your client for success. You can hover over the Ash Rating to discover score criteria.

To see the expanded underwriting information, just click the expand and collapse arrow on the right-hand side. The drop-down will give you information to make an informed decision based on underwriting outcomes from similar cases.

Visit your Ash Advisor Portal. On the homepage, click the Ash Term Express tile.

Visit your Ash Advisor Portal and select Cases. You will be able to view all updates regarding your submitted case.

The Ash Term Express platform is built on data for clients just like yours. You can be sure the platform quickly analyzes the client’s information and lets you see which accelerated underwriting program is best, if applicable. And, it tailors necessary information based on client responses and carrier selection, so no time is wasted answering unnecessary questions. It also guides you to the most accurate health class, so you get the quote right the first time.

Information entered into the Ash Quoter flows straight into the Ash Express Application, so you save time and don't have to enter information twice.

Retirement Solutions

Up-to-date rate information - including best-in-class product picks - is always available on our Advisor Portal. Just select Annuities from the Product menu and click Annuity Rate Watch. When you need an annuity quote rate sheet, our retirement case design team is here to help you find the most suitable product. Whether it's a fixed annuity, indexed annuity, SPIA, DIA, MYG or another solution, we'll help find something that fits your client's profile. Due to the volatile interest rate environment, all information should be verified prior to presenting to clients. Please contact us prior to quoting. Rates are deemed accurate but not guaranteed.

Everything is done online through an electronic contracting system called SureLC. You'll want to log in to the Advisor Portal. From the homepage, click on the Contracting tile, then choose Online Contracting.

For the initial setup, your information pulls directly from the National Insurance Producer Registry – it may be as easy as verifying no changes are needed or completing your profile that includes submitting your signature card, Errors and Omission coverage, AML, and if directly paid, direct deposit information.

After setting up your initial profile with our online contracting system, you can request additional insurance carrier contracts at the click of a button. You can also update any contracting documents such as AML, E&O, or bank information. No more unnecessary duplication of efforts, redundant questions or searching for up-to-date paperwork. It’s fast, paper-free, and it’s always available when you need it.

If you need help, our Commissions and Contracting team is available to make sure the insurance process never stands in the way of progress.

All training requirements can be found by logging in to the Ash Advisor Portal. Once logged in, scroll to the bottom of the page and click Training Requirements under the Contracting header. You can also look the pre-appointment requirements up by state by clicking Pre-Appointment under the same menu.

Each state and insurance carrier has different requirements, and many require you to complete training or be appointed prior to soliciting business. In those states, if an application is submitted before contracting is complete, the application cannot be accepted and a new application may be required.

With no ticket charge for you or your firm, FireLight is an electronic annuity application platform that makes doing business faster and easier – from anywhere.

It’s another tool in our partnership to support you from a fiduciary standard perspective. You’ll always have the most up-to-date forms, alleviating the back and forth of gathering requirements. And, with apps in good order 91 percent of the time, plus the ability to sign from any location, it nearly eliminates the need to return to clients for extra information.

To annuitize is to convert the accumulated value of an annuity into a stream of income. The payments may be a fixed amount for a fixed period of time or for a lifetime.

A direct transfer is a method of moving qualified funds from one trustee to another without triggering a taxable event. Transfers often occur between two financial institutions but they can also be between contracts or accounts at the same institution. To qualify as a transfer:

- It must be between “like-kind” plans (e.g. Traditional IRA to Traditional IRA, TSA (Tax Shelter Annuity) to TSA

- There must be no constructive receipt of the funds. In other words, the check must be payable and directed to the receiving financial institution as trustee

A direct rollover is a method of rolling certain distributions from a qualified retirement plan or TSA to another kind of qualified retirement plan (e.g. TSA to a Traditional IRA, 401(k) to a Traditional IRA). To qualify as a direct rollover:

- The funds distributed must be an “eligible rollover distribution” which can generally be described as a distribution received upon a qualifying event such as retirement, termination of employment, attainment of age 59½, or disability. Regulations specify certain items that are not considered eligible rollover distributions (e.g. required minimum distributions)

- The receiving qualified retirement plan must allow rollovers from other parties

- The funds must be transferred directly from one financial institution to another for your client’s benefit. In other words, the check must be payable and sent to the receiving financial institution as trustee

A 1035 exchange is the exchange of an insurance contract for another that meets all the requirements of Section 1035 of the Internal Revenue Code (IRC 1035). When a contract is exchanged under IRC 1035, the gain or loss of the exchanged contract is transferred to the new contract. Requirements for non-taxable treatment include:

- The owner and the insured/annuitant on both contracts must be identical

- The contract being exchanged must be in force. If the contract is maturing, the 1035 exchange must be signed prior to the maturity date

Access the Ash Advisor Portal. Once logged in, click on the "Annuity Hub" tile on the homepage and a single sign-on will take you into the Luma platform. Once there, you can choose “Product Marketplace” to start comparing products and rates.

Luma Financial Technologies began over 10 years ago with a mission to create a fully customizable, multi-product, multi-issuer, carrier-neutral platform that would take the hassle out of managing complex financial products. Their platform has earned Luma the privilege of partnering with some of the largest financial institutions in the world — helping originate over $25B annually. With their new annuity platform, you can learn, order, configure, and track annuity products in one place.

Luma and Ash Brokerage have a partnership to provide you with the best in annuity technology but are not affiliated.

Long-Term Care

Your goal for an initial long-term care planning conversation should be to simply confirm the need to create a plan. Don't make it about price or start with a quote for an insurance-based product.

If you've had a good conversation that led to the possibility of using long-term care insurance, we'd love to talk to you about your client's goals, funding strategies and health. You can call us, use the LTC PreView tool on the Ash Advisor Portal, or start by completing our LTC quote request form.

LTC underwriting depends on what medical conditions your client has and how well-controlled they are. Although we can’t be sure of what’s in a client’s records, pre-qualifying your client is the best way to get a realistic idea of approval. Our LTC PreView tool is a great way place start.

Don't make it about insurance, product or cost. Start a planning conversation to determine their goals and mindset.

You can find conversation starters and ideas for overcoming objections in our LTC Conversation Guide.

Everything is done online through an electronic contracting system called SureLC. You'll want to log in to the Advisor Portal. From the homepage, click on the Contracting tile, then choose Online Contracting.

For the initial setup, your information pulls directly from the National Insurance Producer Registry – it may be as easy as verifying no changes are needed or completing your profile that includes submitting your signature card, Errors and Omission coverage, AML, and if directly paid, direct deposit information.

After setting up your initial profile with our online contracting system, you can request additional insurance carrier contracts at the click of a button. You can also update any contracting documents such as AML, E&O, or bank information. No more unnecessary duplication of efforts, redundant questions or searching for up-to-date paperwork. It’s fast, paper-free, and it’s always available when you need it.

If you need help, our Commissions and Contracting team is available to make sure the insurance process never stands in the way of progress.

Most individuals who need ongoing care require assistance with day-to-day living, not skilled medical attention. Medicare only covers skilled care after hospitalization, which would not help in those circumstances. It’s designed to pay for severe, short-term illness only.

Medicaid is essentially a welfare system – and it feels like it. If your client’s plan for long-term care is to spend their entire life savings, only to end up on welfare, then why plan for retirement at all?

For more information on how to guide clients through a planning discussion, check out our Conversation Guide to Long-Term Care or contact us.

Partnership plans are LTC policies that meet state guidelines and are designed to make it easier to qualify for Medicaid after exhausting private LTC benefits. In most states, every $1 of received LTC benefits protects $1 of the client’s assets from spend-down should the client need Medicaid later. The client still needs to meet all other eligibility requirements, and careful attention should be paid when the client purchases the policy in one state and wants to use it in another.

We are available to join you on client calls and walk you and your client through the different parts of an illustration, answer questions and help you both feel confident about what’s being quoted. Just talk to our LTC team to schedule time.

That depends on your client’s goals and funding. Talk with your client about what they want to do and then select the type of coverage that meets those goals best.

Absolutely. Traditional LTC appeals to clients interested in robust coverage and the ability to customize coverage.

We have carriers that will write up to age 79 for traditional coverage, 80 for linked benefit based on life insurance and age 85 for lined benefit based on annuity coverage. Benefits might be limited at older ages, and health conditions can make it harder to qualify.

Although wealthy clients can choose to self-insure, it’s usually more cost-effective to transfer at least some of the risk to an insurance company.

What they should NOT do is cancel their coverage. Instead, talk with our LTC team about the case. We can help with ways to modify benefits and keep the coverage in force.

In most circumstances, cash value can be transferred with a 1035 exchange to a hybrid life insurance policy. By using a 1035 exchange, the client doesn’t experience a taxable event.

Unlike life insurance, LTC costs are lower if someone lives for a shorter time. Since women tend to live longer than men and use more long-term care benefits, it costs more to cover them. And that means higher rates.

A 1035 exchange is the exchange of an insurance contract for another that meets all the requirements of Section 1035 of the Internal Revenue Code (IRC 1035). When a contract is exchanged under IRC 1035, the gain or loss of the exchanged contract is transferred to the new contract. Requirements for non-taxable treatment include:

- The owner and the insured/annuitant on both contracts must be identical

- The contract being exchanged must be in force. If the contract is maturing, the 1035 exchange must be signed prior to the maturity date

Disability Insurance

There are a lot of factors involved with each opportunity, and because of the complexity, DI quotes can’t be run online. We’ll create an illustration tailored to your client, then give you the product-specific ideas and sales support to help secure the deal. You can start by giving us a call or filling out a quote request form.

The process of determining if your client will qualify for disability insurance is called underwriting. Underwriting for DI is different than life insurance underwriting, since DI coverage protects against the risk of morbidity, while life insurance uses mortality data to assess the likelihood of death.

Disability insurance carriers exclude certain occupations from coverage, but eligibility is primarily based on the information you can provide about your client. This process is called field underwriting — your initial data gathering before any quotes are run. The more our team knows, the better we can determine if your client will qualify. Some key factors include:

- Occupation with specific daily duties

- Date of birth, height and weight

- State of residence

- Tobacco user status

- Any medical issues, including back or heart trouble, sleep apnea, stress, anxiety, depression, etc.

- Income/business information

- Employees: W2 income

- Business Owner: Net taxable reportable income, how long they have owned the business and how many employees they have

If you need help asking the right questions, our DI Quote Request form is a good place to start, or you can call our team to talk through your client’s eligibility.

Insurance companies define disability in one of three ways: Total, residual or catastrophic. See below for an explanation of each potential situation. You don’t have to be totally disabled and unable to work – you can potentially go back to work or get a different job while receiving benefits.

Total Disability

Your Occupation: Unable to perform substantial and material duties of your occupation and not working in any occupation

Regular Occupation: Totally disabled from regular occupation and choosing to work in another occupation; benefits are provided regardless of income earned from other occupation

Transitional Occupation: Unable to perform substantial and material duties of regular occupation, but working in another occupation; benefits are based on replacement of pre-disability earnings up to 100 percent

Residual Disability

Elects to work in another occupation, return to work full-time or work at a reduced capacity in “your occupation” and have a loss of earnings; benefits are proportionate to the loss of earnings

Catastrophic Disability

Cannot perform two or more of the Activities of Daily Living: bathing, continence, dressing, eating/feeding, toileting or transferring; or is cognitively impaired or presumptively disabled

Everything is done online through an electronic contracting system called SureLC. You'll want to log in to the Advisor Portal. From the homepage, click on the Contracting tile, then choose Online Contracting.

For the initial setup, your information pulls directly from the National Insurance Producer Registry – it may be as easy as verifying no changes are needed or completing your profile that includes submitting your signature card, Errors and Omission coverage, AML, and if directly paid, direct deposit information.

After setting up your initial profile with our online contracting system, you can request additional insurance carrier contracts at the click of a button. You can also update any contracting documents such as AML, E&O, or bank information. No more unnecessary duplication of efforts, redundant questions or searching for up-to-date paperwork. It’s fast, paper-free, and it’s always available when you need it.

If you need help, our Commissions and Contracting team is available to make sure the insurance process never stands in the way of progress.

This is a critical aspect for DI underwriting. For W2 you'll need last year’s W2 and a recent pay stub. For business owners, you'll need the last two years of tax returns with all schedules. We'll serve as your client’s advocate with insurance company underwriters.

Ash Brokerage has a range of solutions available to meet your clients’ needs. Our carriers have white-collar, middle America or special/impaired risk focuses:

- For white collar, Petersen International, Principal and The Standard

- For middle America, Assurity, Illinois Mutual and Mutual of Omaha

- For blue collar, Assurity, Fidelity and Petersen International

Clients receive benefits after incurring a qualifying disability and satisfying the policy’s waiting period, often referred to as an elimination period. As a rule, the shorter the elimination period, the more expensive a policy will be. It’s important for clients to understand that benefits are typically not paid until the end of the month following the elimination period.

- Most people choose either a 90-day or 180-day elimination period

- Clients will want to consider their available savings and assets when making this choice

The answer is twofold. First, when clients are disabled, the benefit period is the length of time they’re paid. The shortest option is two years, but the most common benefit period is five years. Second, their policy will have an age limit – most people purchase coverage that lasts until age 65.

- Clients should buy a policy with the longest benefit period they can afford

- Coverage may be adjusted for a longer benefit period in the future; additional underwriting may be needed

Benefits are based on a percentage of your client’s income. The maximum amount depends on a variety of factors, such as current income, occupation and existing coverage.

Policies can be designed to meet most needs and budgets – from maximum income protection to safeguarding specific expenses, such as a mortgage. Typically, premium costs between 1 and 3 percent of the client’s annual income.

Technology & Innovation

The platform currently includes updated case information for both life insurance and annuities. Business details for DI, LTC and linked benefit product lines will remain visible in the Cases section on the Ash Advisor Portal.

We're only displaying information in In-Force Vision that we can verify is current and accurate. The data is coming directly from the insurance carrier partners. Typically, a policy with a connected carrier will show up in In-Force Vision 2-3 months after the policy is first put in force.

While we have many carriers connected, not all are participating. If a specific policy isn't shown on In-Force Vision, it means we are not getting current and consistently updated data feeds on it from the carrier. Any data for active policies that is older than 60 calendar days will not be displayed.

If a policy is not showing in In-Force Vision, your entire book of business placed through Ash Brokerage can always be viewed from the Cases section of the Advisor Portal.

Due to carrier hierarchy and compliance arrangements, we can only access and display policy details for cases written through Ash Brokerage. We are actively working to find a solution to include outside production and will provide updates on that process as we are able to.

Data is updated once a month. Data surfaced is based on the previous six months of information collected.

Ash Brokerage is receiving in-force updated information from each carrier approximately once a month. The date of the updates varies across the carriers and is reflected on the case details under the Last Updated section. Any data for active policies that is older than 60 calendar days will not be displayed.

Cases placed in force will not be immediately available for viewing but will typically be included within the following 2-3 months, depending on the update cycle for that company.

Currently, you can see case information for one advisor at a time. If you have delegation access to view cases for other advisors, you can do so, but separately. Also, cases currently only show up for the writing, primary advisor when multiple advisors are splitting commission on a case. We plan to add the ability to view multiple advisors, full office policies and split case details in future system enhancements.

Insurance carriers do not provide the final conversion date to us. The Ash system has gathered historical conversion rules from all the carriers and uses logic to estimate the conversion timeframes. Please reach out to our Ash Policy Owner Services team at policyownerservices@ashbrokerage.com to confirm any details prior to submitting a conversion application.

If you would like to obtain additional information on any specific cases, please reach out to our Ash Policy Owner Services team at policyownerservices@ashbrokerage.com.

It's our pleasure to help gather information on cases and assist with post-issue service items. Please note that while we do not have the capacity to proactively research all policies not included on In-Force Vision at the same time, we will be happy to help on a case-by-case scenario as the needs arise.

Not yet, but we are working to add that capability into the platform soon, so stay tuned! Feel free to take screenshots for now, or call your Ash Protection Risk Management Consultant for assistance.

As of April 2024, we have active feeds from:

Life Insurance

- Allianz

- Banner (Legal & General America)

- Corebridge (American General)

- Equitable (AXA)

- Genworth (Permanent products only)

- John Hancock

- Lincoln Financial

- Mutual of Omaha

- Nationwide

- Pacific Life

- Principal

- Protective

- Prudential

- Symetra

- Transamerica

Annuities

- Allianz

- American Equity

- American National

- Athene

- Corebridge (American General)

- Equitrust

- Fidelity & Guaranty

- Genworth

- Great American (MassMutual Ascend)

- Guaranty Income Life

- John Hancock

- Lincoln Benefit Life

- Lincoln National

- Midland National

- Mutual of Omaha

- Nationwide

- North American

- Principal

- Protective

- Reliance Standard

- Standard

- Symetra

- Voya

- Western & Southern (Integrity and National Integrity of NY)

In-Force Vision utilizes the most current data received from insurance carriers to provide accurate policy details. The Cases section on the Ash Advisor Portal provides static information about all historically written, closed, informal and formal business. Once a policy is put in force, the policy data in the Cases section is no longer updated, but In-Force Vision is.

Visit your Ash Advisor Portal. On the homepage, click the Ash Term Express tile.

The Ash Term Express platform is built on data for clients just like yours. You can be sure the platform quickly analyzes the client’s information and lets you see which accelerated underwriting program is best, if applicable. And, it tailors necessary information based on client responses and carrier selection, so no time is wasted answering unnecessary questions. It also guides you to the most accurate health class, so you get the quote right the first time.

Information entered into the Ash Quoter flows straight into the Ash Express Application, so you save time and don't have to enter information twice.

Working With Ash

Ash Brokerage has partnerships with more than 80 top-rated insurance carriers that we work with on life insurance, linked-benefit solutions, long-term care insurance, disability insurance and annuities.

You can view our carrier list to view our full portfolio of insurance companies available.

New York carriers may be limited. Information is for reference purposes only, and not necessarily representative of actual products or companies available for sale. Actual availability may be limited by your state, agency, broker-dealer or affiliated organization. Please consult your internal wholesaler, marketing representative, home office liaison or agency manager to confirm carrier and product availability.

Additionally, product information is compiled from carrier and industry data. It is deemed accurate but not guaranteed. All information should be verified prior to presenting to clients.

We seek to be responsive and available when you need us. Between 7 a.m. and 6 p.m. Eastern your call will be answered and directed by a real person. With a nationwide presence, your dedicated Ash team may be available outside these hours based on regional support.

You can always get up-to-date information on your cases, run a quote or submit an electronic app by logging in to our Advisor Portal.

With such a large team to support you, we don't have a single department contact list. Our promise is to match you with dedicated individuals, so you always feel like you know who to reach out to. We believe phone calls should be answered by real people, so you can always call (800) 589-3000 and we'll direct your call.

If you are looking for a specific department, start with our find a contact section. It contains some friendly faces from each area of our business who can answer your question or get you to someone who can. You can also complete our contact form if you have a general question and don't know where to direct it.

If you still feel lost, reach out to our Client Experience team and we'll point you in the right direction!

The Ash Advisor Portal is your tool to access the entirety of Ash Brokerage’s technology platform. It’s built to help you manage and grow your business through a client dashboard, case status, easy quoting and submission, online contracting, pre-underwriting tools and more.

Many people confuse the Ash website with the Advisor Portal. The website is what you are on now — full of educational content and information about Ash. For the Portal, you'll need a producer login to view the platform. You can access the Portal direct from the main Ash website by clicking the "Advisor Login" button. The first step is to create an account and then follow the login instructions.

Set up portal login

If this is your first time, setting up online access is easy. Visit https://portal.ashbrokerage.com/ and click the register now button. Registering as a new user is essentially the same as registering with Ash Brokerage. Complete the signup form and then click on the link in your email to confirm your email address. Once you verify your email address, your account will be active. In some cases, the link sent may have expired. If you need a new link, reach out to our IT helpdesk at (800) 589-3000.

Reset password or change password

If you can't remember what your password is, you can click reset password on the login screen of the Portal, then follow the prompts. If you are logged in to the Portal and want to change your password, click on your name in the top right, and choose Profile. There is a link on the screen to change your password. If you need assistance, please contact our IT helpdesk at (800) 589-3000.

Unable to log on

If you find that something on the site is not working as expected, you may not be able to log in. It may be as simple as you forgot your password or changed your email address. If your login or password is still not working correctly, please contact our IT helpdesk at (800) 589-3000 for assistance.

Accounts using single sign-on

Some account relationships may have established a single sign-on (SSO) as the primary way of accessing the Ash Portal. In that case, you may not have a password and will need to access the Portal directly from your company's designated site.

The process for application submission varies by carrier and business line. There are also different procedures based on whether you are using an e-app or a paper application.

Typically, the easiest method for submitting an application is to access the Advisor Portal and use an electronic application. If it’s your first time, you’ll need to create an account. Once you have logged in, use the Applications menu from the main navigation, or click the “Submit an App” tile on the homepage.

Term Life Insurance Applications

If you need to apply for life insurance, you should start with Ash Express for all term opportunities. This will provide you with the fastest service, with a better experience for your clients.

Annuity Applications

Annuity apps are usually processed through electronic applications on the Advisor Portal. An annuity application cover sheet is not needed.

Other Business Lines

For permanent life, linked-benefit, disability insurance or long-term care applications, please choose the “Other Life, LTC or DI apps” button on the applications page. This will connect you to our vendor, iPipeline, to search for and complete an application. If your product is not available, you may need to use a paper application.

Paper Apps

If you need to print an application, choose the Paper Forms option from the Applications menu. We recommend the use of electronic apps whenever possible, but understand that it is not always available for all products and carriers. Paper forms can be scanned and emailed to:

- Life Insurance: IGO@ashbrokerage.com

- Annuities: AnnuityIGO@ashbrokerage.com

- Traditional Long-Term Care: LTCIGO@ashbrokerage.com

- Linked Benefit: imaging@ashbrokerage.com

- Disability Insurance: DIIGO@ashbrokerage.com

You can also fax it to (260) 478-3980.

Application and Check

If you are mailing a check, please send it to P.O. Box 2572, Fort Wayne, IN 46801. If sending via FedEx send it to 888 S. Harrison St., Suite 900, Fort Wayne, IN 46802

Application Support

If you still don’t know where to get an application or how to submit, our Client Experience team can help you get started.

In most cases, you will not be required to be contracted prior to writing an application.

Most carriers follow a process called Just-In-Time (JIT) when contracting an individual. This means your contract will be finalized and completed once you have new business at the carrier.

There are situations where you may need to be contracted prior to taking an application, known as pre-appointment. You can check pre-appointment carriers and states in the Advisor Portal, or feel free to contact our Producer Services team at (800)-589-3000 to discuss your unique situation.

In most cases, training is required to be completed prior to taking an application.

Information on training required for New York, Long-Term Care and Linked Benefit products, and Annuities can be found by logging into our Advisor Portal, clicking the Contracts tile on the homepage, then the Resources and Requirements tile.

Commissions on your recently placed business typically payout 1-2 weeks after the policy is in force. Commissions paying from Ash Brokerage are released weekly via EFT, one week in arrears, leaving Ash on Tuesday and received in your account within 24-48 hours.

Commissions paying directly from the carrier will follow the carrier’s payout guidelines. Carrier payout guidelines can be discussed with our Producer Services team.

The commission pay periods are subject to change based on rules with your broker-dealer.

Updated electronic funds transfer (EFT) information can be sent to producerservices@ashbrokerage.com. Please provide a copy of a voided check or letter from your financial institution with your account and routing numbers. We will confirm the changes with you and get everything processed to make sure you receive commissions at your updated bank account.

If you want to get a clear look at all your cases, the best way is to log in to the Advisor Portal. Click on the Cases tile on the homepage to view your entire case history. You can also run reports by line of business, status, date or just about any field in our system.

For specific questions, your case manager is always available to provide updates in whatever form it's best for you. From scheduled reports to recurring status calls, we'll keep you informed on the process from application through delivery. If you don't know who your case manager is, you can find a contact to get in touch with a case manager who will get you to your dedicated resource.

If you are looking for a paper application for a specific insurance carrier, you can access our full forms library on the Ash Advisor Portal, then find the company, state and product you need. For more details, check out the How Do I Submit an Application FAQ.

Below are some other common forms that may be helpful:

- Preliminary Inquiry (Informal questionnaire for life insurance health pre-screening)

- Ash Authorization (HIPPA form required with all paper apps)

- In-Force Authorization (Used for Ash Life Audit)

If you are looking for additional forms, such as requesting medical records, change of beneficiary, cover sheets or impairment questionnaires, please contact your case management team.

This is not necessary. Once you are set up with Ash Brokerage, we receive a feed from the National Insurance Producer Registry (NIPR) with all updated licenses. If you have questions, please reach out to our Contracting team.

Your Ash team and the carrier are instantly notified that a new application is submitted, and they are able to take action and move the case to the next step. Ash and the carrier will handle communication with the client. You can review the status by visiting your Ash Advisor Portal and clicking on the Cases tile on the homepage.

If your client does not qualify for accelerated underwriting, we will provide an alternate submission process for traditional underwriting. Your client will need to sign the application, which will be collected electronically at the client’s convenience.

Give us a call at (800) 589-3000

Between 8 a.m. and 6 p.m. Eastern, your call will be directed to a self-service menu. At any time, press 9 to return to the main menu or press 0 to speak to the advisor support team.

Option 1 - Life

- Option 1 — Sales/Quotes/Illustrations — ext. 237256

- Option 2 — Case Management — ext. 237204

- Option 3 — Contracting/Commissions — ext. 237227

- Option 4 — Policy Owner Services — ext. 237252

- Option 5 — Advanced Case Design — ext. 237260

Option 2 - Annuities

- Option 1 — Sales/Quotes/Illustrations — ext. 237244

- Option 2 — Case Management — ext. 237203

- Option 3 — Contracting/Commissions — ext. 237281

- Option 4 — Firelight Assistance — ext. 237244

- Option 5 — Policy Owner Services — ext. 237252

Option 3 - Long-Term Care & Linked Benefit

- Option 1 — Sales/Quotes/Illustrations — ext. 237254

- Option 2 — Case Management — ext. 237218

- Option 3 — Contracting/Commissions — ext. 237227

- Option 4 — Policy Owner Services— ext. 237252

Option 4 - Disability

- Option 1 — Sales/Quotes/Illustrations — ext. 237255

- Option 2 — Case Management — ext. 237253

- Option 3 — Contracting/Commissions — ext. 237227

- Option 4 — Policy Owner Services — ext. 237252

Option 5 - Medicare

You can also visit our contact page to view additional phone numbers and contact information.

Ash Brokerage may send you emails from several different employees and systems. We try to connect them and respect your subscription preferences when possible. Here are a few things to check:

Update your primary email address

If you want to change the email associated with your account, please reach out to our Producer Services team and ask to have your email address updated in Ash's system. This may affect the email address you use to log in to the Advisor Portal, and you may need to re-register to access your existing data.

Review your marketing email subscriptions

You can modify your email preferences for newsletters, product updates, webinar updates, and similar emails by visiting our email subscription center. If you don't want to modify which publications you receive but wish to have them sent to a different address, contact the Producer Services team.

Health insurance is not one of the products that Ash Brokerage distributes.

However, we are committed to helping advisors help their clients protect their health and wealth. For an aging population, we can help address healthcare in retirement through both Medicare Solutions and Long-Term Care insurance.

We also have an extensive network through our Integrity Marketing Group partners and can help connect you with a solution.

We’re happy to provide this for you. Please email our team at inforcesalesmanagement@ashbrokerage.com. Let us know which lines of business (or all of them) you’d like included. The reporting will be emailed back to you in an Excel spreadsheet. This will include updated policy values and information on tracked life insurance and annuity policies written through Ash Brokerage. All other lines of business will include a record of policies sold without current policy updates.

We create and connect with advisors on outreach campaigns in three subsets:

New Sales Opportunities: Including term conversions, end of level term tracking, policies that may benefit from an Ash Life Audit review, loan rescue tracking, multi-product line solutions and more.

Revisiting Lost Opportunities: Including postponed cases, accessing outstanding commission bonuses on specific products, working with carrier partners for outside-the-box solutions and more.

Educational Touchpoints: Including estate tax planning, product-specific client benefits, supreme court decisions impacting our industry and more.

Absolutely, we’re here to support you in mining all your placed business! To begin, download and look at this guide to see the information we need to help.

Please send us an email at Inforcesalesmanagement@ashbrokerage.com . We can use our up-to-date database to find the most recent contact details for your client. Please note that we can only provide this service for former and existing clients, not for new potential marketing outreach efforts.

Send us an email at Inforcesalesmanagement@ashbrokerage.com with the type of outreach you’re looking to do. We are continuously updating our email marketing templates and will gladly share the most updated versions with you. You may then customize it to your liking and use it to connect with your clients.

Please see our resource guide on term conversions. We can help you process a term conversion even if you didn’t write the original term policy. Conversion allows the insured to purchase a permanent insurance policy without having to go back through medical underwriting.

Send us an email at inforcesalesmanagement@ashbrokerage.com . If we have this policy on our in-force data feeds, we will share those details with you. If we don’t have access to the policy, you require additional information, or need to make changes, we will connect you with our Policy Owner Services team. They can assist you further with additional post-issue service and support.

Please reach out to our Policy Owner Services Team at policyownerservices@ashbrokerage.com or (800) 589-3000 ext. 237252. They provide servicing support for in-force policy changes.

Policy Owner Services

It is best to continue to send any requests via the PolicyOwnerServices@ashbrokerage.com email. We have a team of people monitoring this box daily. If someone is already working on a request for you, your email will be sent back to the team member handling your request.

After submitting a request to the PolicyOwnerServices@ashbrokerage.com email, we strive to respond within 1-2 business days. However, requests are handled in the order in which they are received, so times may vary during high-volume periods.

When a request is sent to a carrier, each type of request and each carrier have different servicing time frames. In most cases, if there are no issues with the request being sent, you should have something back between 5-10 business days, depending on the request. Unfortunately, some of our older carriers no longer have large customer service teams, so hold times are long, and requests are not always handled as quickly as we would like.

Some carriers that typically see extended wait times include MetLife (Brighthouse), Penn Mutual, Lincoln Benefit Life (Allstate) and Transamerica.

Electronic submission, through a service such as Docusign, is not allowed by most insurance carriers on in-force service forms. The majority must be hand-signed.

The policy owner services team can provide you with any in-force service-related forms for carriers that Ash Brokerage has a contract with.

If you would like to pull forms, you can access the Ash Advisor Portal, then choose Applications > Paper forms. Click on the "paper applications" button to launch the iPipeline forms engine. Fill in the pertinent information about carrier, state and type of form, then download the form packet.

You can also download forms directly from insurance carrier websites if you're registered.

Since Ash Brokerage works with numerous insurance carriers, our team is not versed in how to complete every form. It is recommended that you complete the form in its entirety.

Most forms have instructions on how to complete the form successfully. If you need further assistance, we can contact the carrier on your behalf to get an answer. For a quicker response, we recommend you contact the carrier directly with your question.

Before submission, the Ash team will always check the form for policy number, signature and date.

We do our best to help with cases that were not written through Ash Brokerage. To begin, our team will need to know the name of the writing agent and the last four digits of their Social Security Number.

However, we are not always successful in obtaining information on policies not written through us. Some carriers may require a special authorization to be signed prior to releasing any information. There are also some insurance carriers where Ash Brokerage no longer holds contracts. For those companies, we will be unable to gather information if Ash Brokerage is not connected with the policy.

In those cases, it’s always best for the policy owner to call.

Ash Brokerage is not always privy to lapse notifications, as carriers will send them directly to the policy owner. Some carriers may send a notice to the agent. Very few are sent to Ash.

If we are notified of a lapse pending policy or a lapse notice, we notify the agent of record once we see that correspondence.

It’s always best to register for the carrier sites to look at all of your policies written so you can do a review of your policies. For select carriers, Ash's In-Force Vision tool is a great resource for up-to-date information.

The Ash Policy Owner Services team handles all inquiries related to owners requesting to make a change to an in-force policy. Here are the key tasks that the team can assist with:

- Beneficiary Changes

- Client Address / Name Changes

- Client EFT Updates / Changes

- Conversion Details

- Annual Statements

- Copies of Billing Notices

- Current Values

- Death Benefit Reductions

- Duplicate Policy Requests

- Blank Forms for Inforce Service Requests

- Inforce Illustrations

- Inforce Status

- ITR / 712 Values

- Mode Changes

- Ownership Changes

- Paid To Date Status

- Policy Details/Summaries

- Premium Changes

- Premium History

- Rate Reconsiderations

- Verifications of Payment Received

- Death Claims – Most carriers want a death claim handled by the beneficiaries. We will attempt to notify a carrier of a forthcoming death claim, but are limited to information. In this case, it's best to have a beneficiary call.

For life insurance increase in coverage or conversion quotes, please contact PracticeSupport@AshBrokerage.com.

For other inquiries, start by contacting the Producer Services team at ProducerServices@ashbrokerage.com. Some of the most common requests Producer Services handles are related to contracting, commissions, communication preferences, demographic updates, required training and becoming the agent of record on a policy.

If you send a request to the policy owner services team that falls outside our expertise, we will pass it on to a team that handles the request and they will follow up with you.