Life insurance is entering the next generation. Digital. Fast. Transparent. Check out these exclusive products, tools and services that are revolutionizing the way life insurance is sold.

Exceptional service is just a call or click away. Let us show you how whatever the question, whatever the need, Ash Answers.

You’re ready for a partnership that provides individualized support and a commitment to work with you the way you want. See how we work together.

Here are some of the most common questions we get asked about long-term care. For additional questions, check out our FAQ page.

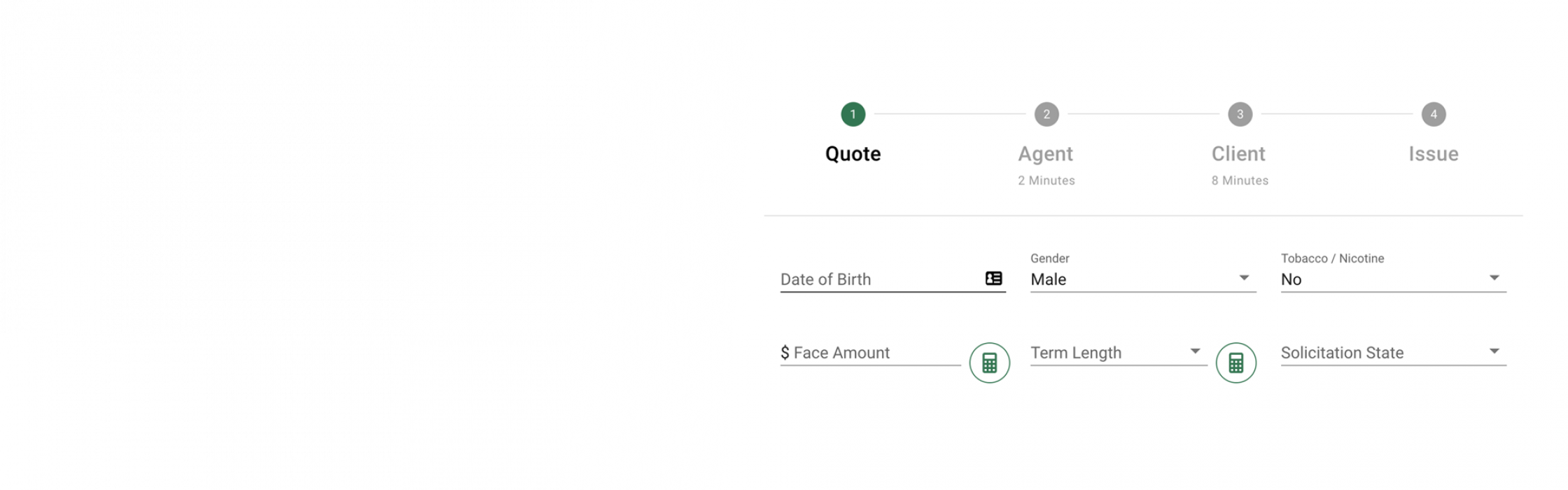

For term life insurance quotes, we recommend you use our Ash Term Express platform. You'll achieve higher placement rates and get policies issued quickly – all in one simple tool.

Available by logging on to the Advisor Portal, Ash Term Express takes the guesswork out of the quoting process. Using insights about health guidelines and accelerated underwriting options, you can easily identify the best match in every situation. And, you can save your quotes for quick retrieval when it's time to start an application.

If you need assistance finding or using the tool, please contact us.

The easiest way is to call the Life Marketing team so we can talk through your client's unique goals and considerations. You can also log in to the Advisor Portal and run an initial quote through iPipeline.

For complex cases, you may want to start by gathering your client's health information using our Life PreView tool. Or you can complete a traditional quote request form to gather the information we'll need to prepare a custom illustration.

Some advisors also like to see the specific life insurance product guide or policy and procedure manual for the carriers they will be applying to. Our Life Marketing team can help get the current materials from our insurance carrier partners.

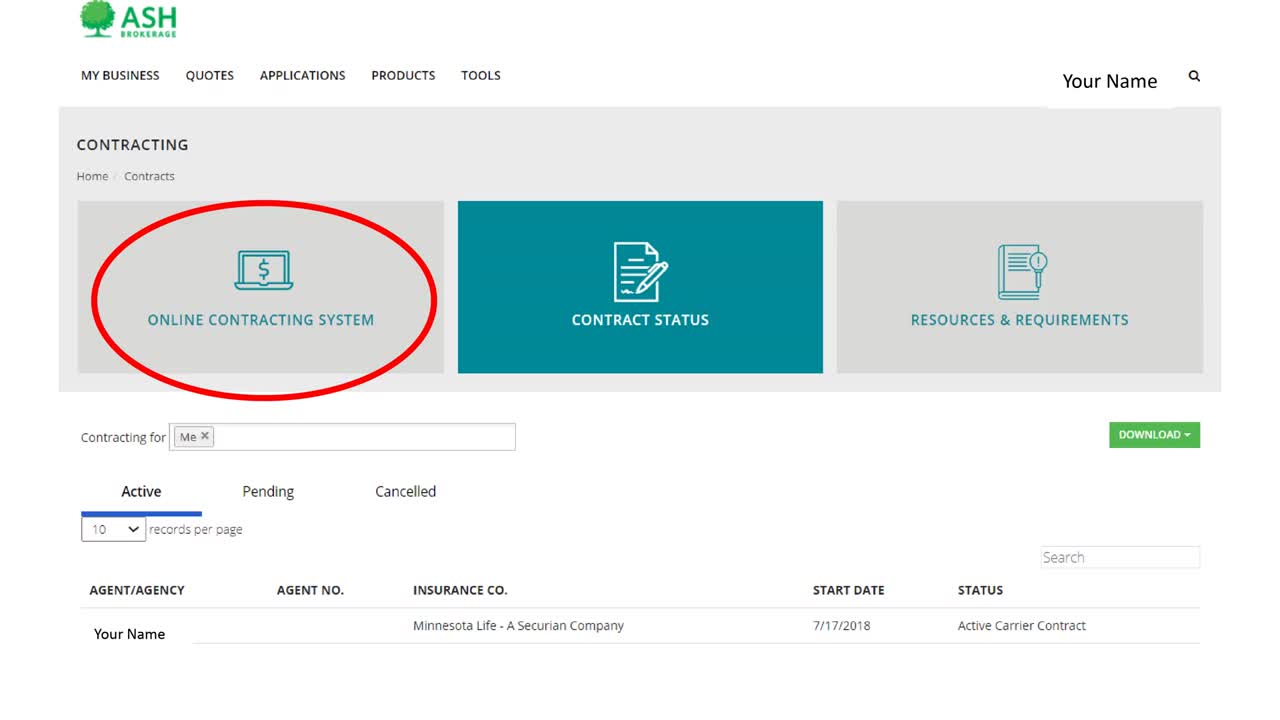

Everything is done online through an electronic contracting system called SureLC. You'll want to log in to the Advisor Portal. From the homepage, click on the Contracting tile, then choose Online Contracting.

For the initial setup, your information pulls directly from the National Insurance Producer Registry – it may be as easy as verifying no changes are needed or completing your profile that includes submitting your signature card, Errors and Omission coverage, AML, and if directly paid, direct deposit information.

After setting up your initial profile with our online contracting system, you can request additional insurance carrier contracts at the click of a button. You can also update any contracting documents such as AML, E&O, or bank information. No more unnecessary duplication of efforts, redundant questions or searching for up-to-date paperwork. It’s fast, paper-free, and it’s always available when you need it.

If you need help, our Commissions and Contracting team is available to make sure the insurance process never stands in the way of progress.

Evidence shows that approval and placement rates are higher with accelerated underwriting (AU). On average, AU cuts the processing time by three weeks. It’s faster and more convenient for you and your client because underwriting is completed based on data, instead of on labs and medical records. And it means less time for clients to change their minds and decline coverage.

But with traditional quoting software, it can be hard to determine which carrier's accelerated underwriting is best for your client, or if they will qualify. With Ash Term Express, we’ve filtered through all carriers’ constantly changing AU programs to bring you the best fluidless underwriting programs. The platform intuitively understands which carrier’s AU process is best for your client, providing an AU score for each program. The AU score is based on AU policy limits, probability of approval as applied for, and average time to place an AU policy.

The Ash Term Express platform is built on data for clients just like yours. You can be sure the platform quickly analyzes the client’s information and lets you see which accelerated underwriting program is best, if applicable. And, it tailors necessary information based on client responses and carrier selection, so no time is wasted answering unnecessary questions. It also guides you to the most accurate health class, so you get the quote right the first time.

Information entered into the Ash Quoter flows straight into the Ash Express Application, so you save time and don't have to enter information twice.