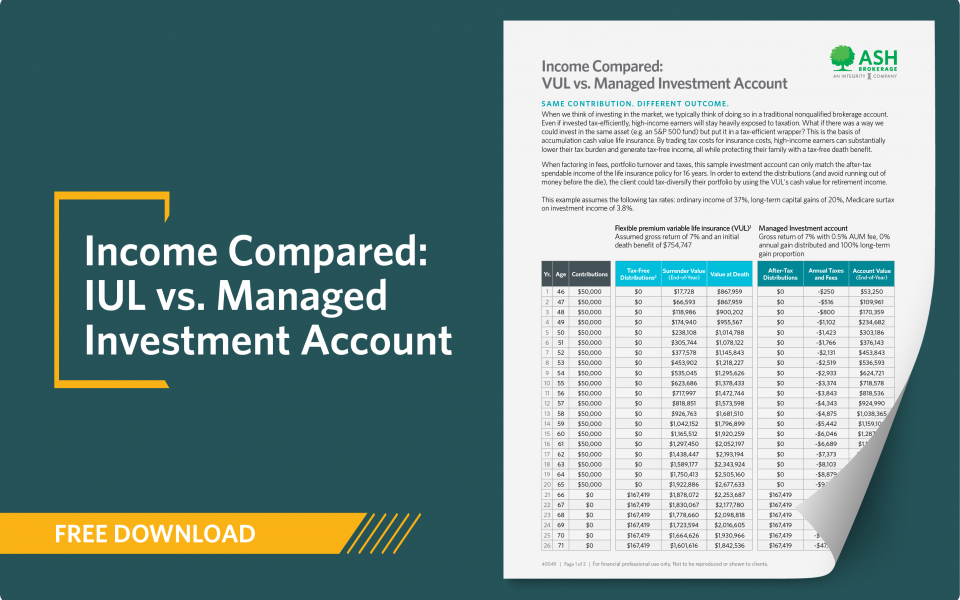

Same contribution. Different outcome. When factoring in fees, portfolio turnover and taxes, can an investment account match the after-tax spendable income a permanent life insurance policy? Diversify a portfolio by using an VUL's cash value for retirement income.

This piece is part of our foundation on how to leverage the benefits of cash value life insurance for tax-efficient income planning. If IRC Section 7702 rings a bell, it's because it is the tax code that allows life insurance retirement plans (LIRP) to have tax-free benefits.