Long-term care is more than a sale. It’s a discussion about health, lifestyle, family and how your clients want to spend their final years. Having a plan is important. Don’t navigate it alone.

Got a question on long-term care? Need an expert? Need someone who is looking out for your clients and your business? Just Ask.

No one knows long-term care planning like we do. With a dedicated team of 20 product LTC marketing consultants, case managers and an underwriter, you can rely on us to be with you from concept to completion. Education. Illustration. Consultation. Application. We’ll not only get it right – we’ll help you present the solution and make sure it makes sense to your clients. Your Ash LTC team is where expertise meets excellence.

You’re ready for a partnership that provides individualized support and a commitment to work with you the way you want. See how we work together.

Here are some of the most common questions we get asked about long-term care. For additional questions, check out our FAQ page.

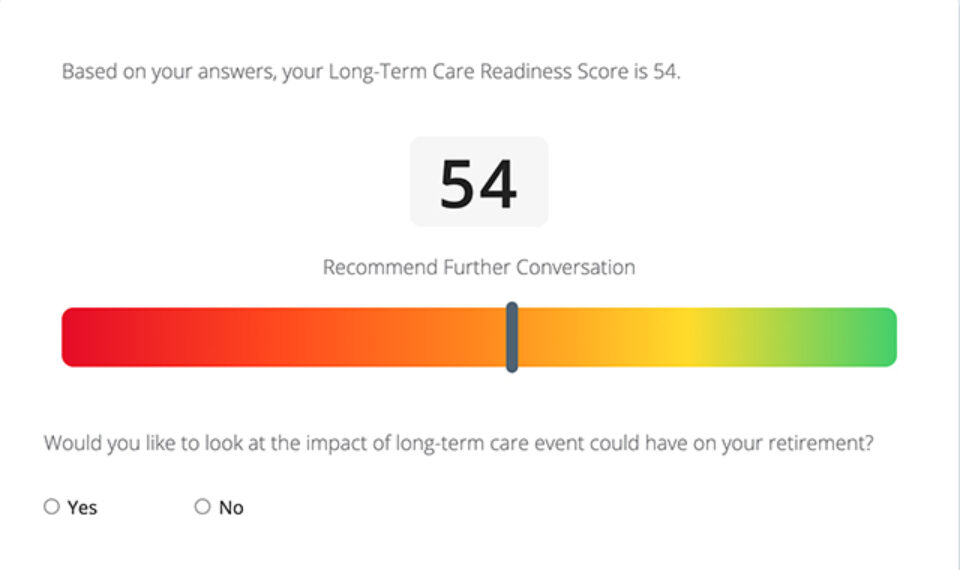

Your goal for an initial long-term care planning conversation should be to simply confirm the need to create a plan. Don't make it about price or start with a quote for an insurance-based product.

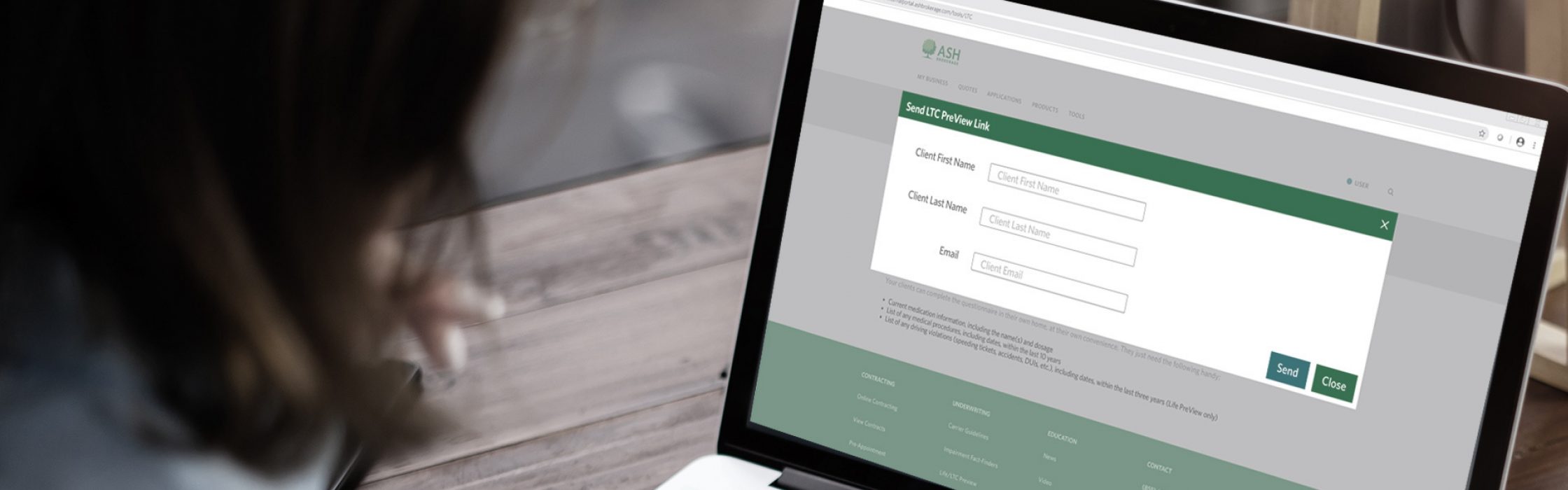

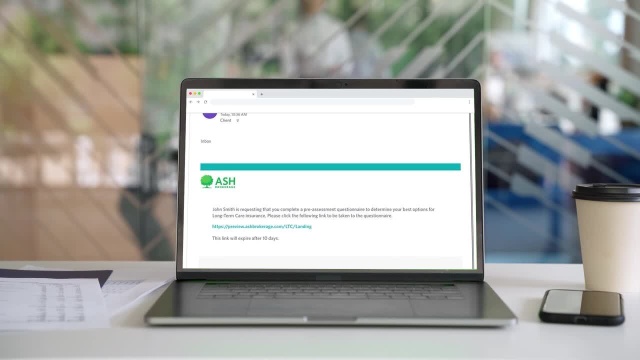

If you've had a good conversation that led to the possibility of using long-term care insurance, we'd love to talk to you about your client's goals, funding strategies and health. You can call us, use the LTC PreView tool on the Ash Advisor Portal, or start by completing our LTC quote request form.

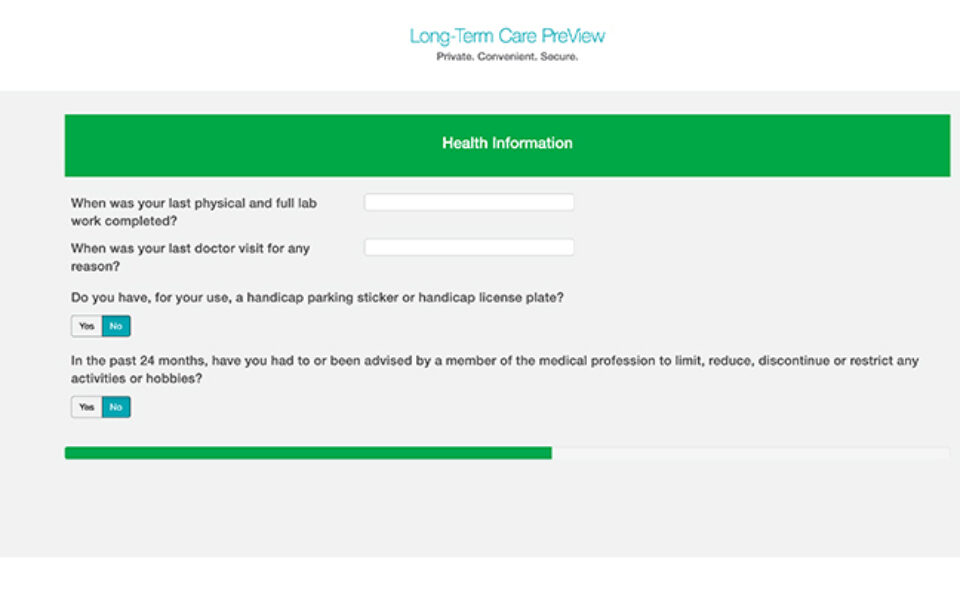

LTC underwriting depends on what medical conditions your client has and how well-controlled they are. Although we can’t be sure of what’s in a client’s records, pre-qualifying your client is the best way to get a realistic idea of approval. Our LTC PreView tool is a great way place start.

Everything is done online through an electronic contracting system called SureLC. You'll want to log in to the Advisor Portal. From the homepage, click on the Contracting tile, then choose Online Contracting.

For the initial setup, your information pulls directly from the National Insurance Producer Registry – it may be as easy as verifying no changes are needed or completing your profile that includes submitting your signature card, Errors and Omission coverage, AML, and if directly paid, direct deposit information.

After setting up your initial profile with our online contracting system, you can request additional insurance carrier contracts at the click of a button. You can also update any contracting documents such as AML, E&O, or bank information. No more unnecessary duplication of efforts, redundant questions or searching for up-to-date paperwork. It’s fast, paper-free, and it’s always available when you need it.

If you need help, our Commissions and Contracting team is available to make sure the insurance process never stands in the way of progress.

We are available to join you on client calls and walk you and your client through the different parts of an illustration, answer questions and help you both feel confident about what’s being quoted. Just talk to our LTC team to schedule time.

That depends on your client’s goals and funding. Talk with your client about what they want to do and then select the type of coverage that meets those goals best.