Digital solutions for life insurance aren’t new. Insurance carriers have been working to streamline the process for years. After all, nobody likes filling out a 50-page term insurance application. And now you don’t have to. Ash Term Express takes the digital experience a step further. Everything you need to write a term application is in one place, regardless of which carrier you chose or which underwriting process your client qualifies for.

And that’s what makes it revolutionary.

Our simple guide to Ash Term Express will help you learn what the platform does, how to put it to work and what happens after the application is submitted.

Don't leave your family to chance. Get in touch with your financial advisor today and ask to use Ash's LIME platform for Life Insurance Made Easy.

Don't have an advisor? We can connect you with a good fit.

Some of our most common questions are below. If you have additional questions, please contact the team below or reach out to the Life Case Design team.

Visit your Ash Advisor Portal. On the homepage, click the Ash Term Express tile.

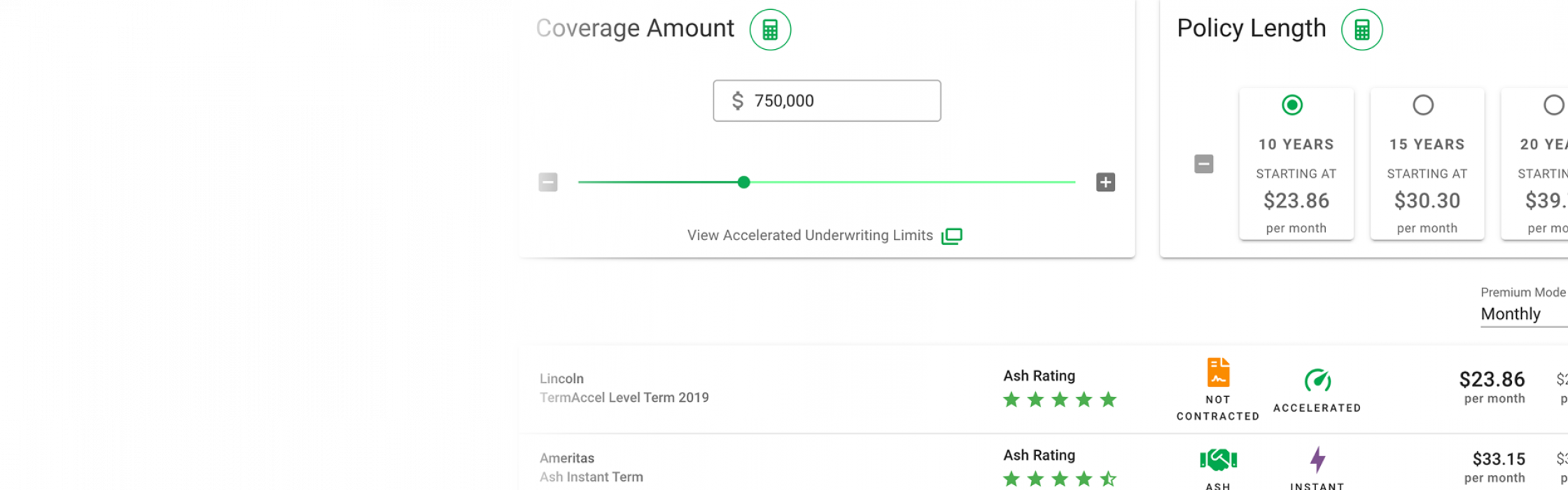

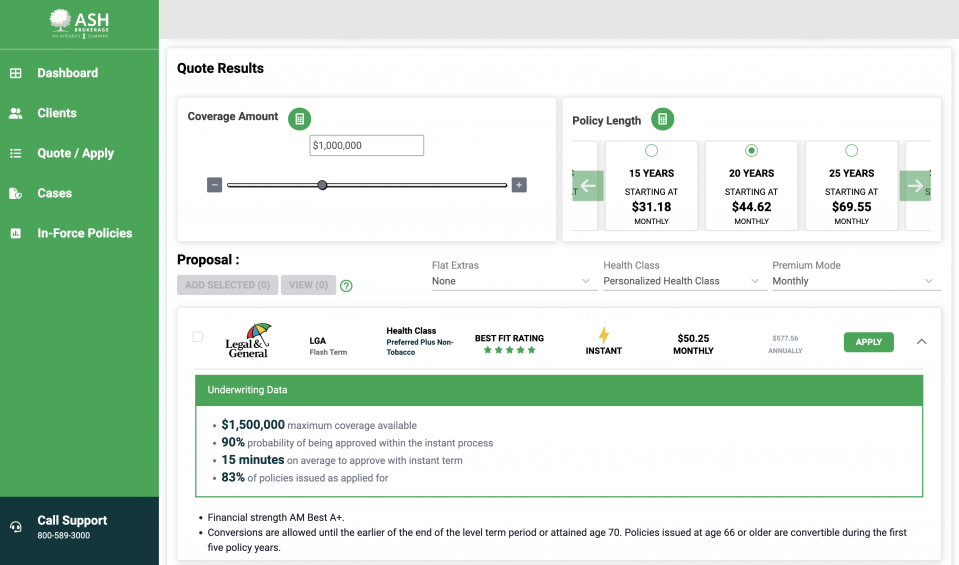

The Ash Term Express platform is built on data for clients just like yours. You can be sure the platform quickly analyzes the client’s information and lets you see which accelerated underwriting program is best, if applicable. And, it tailors necessary information based on client responses and carrier selection, so no time is wasted answering unnecessary questions. It also guides you to the most accurate health class, so you get the quote right the first time.

Information entered into the Ash Quoter flows straight into the Ash Express Application, so you save time and don't have to enter information twice.

Data is updated once a month. Data surfaced is based on the previous six months of information collected.

Visit your Ash Advisor Portal and select Cases. You will be able to view all updates regarding your submitted case.

Evidence shows that approval and placement rates are higher with accelerated underwriting (AU). On average, AU cuts the processing time by three weeks. It’s faster and more convenient for you and your client because underwriting is completed based on data, instead of on labs and medical records. And it means less time for clients to change their minds and decline coverage.

But with traditional quoting software, it can be hard to determine which carrier's accelerated underwriting is best for your client, or if they will qualify. With Ash Term Express, we’ve filtered through all carriers’ constantly changing AU programs to bring you the best fluidless underwriting programs. The platform intuitively understands which carrier’s AU process is best for your client, providing an AU score for each program. The AU score is based on AU policy limits, probability of approval as applied for, and average time to place an AU policy.

Your Ash team and the carrier are instantly notified that a new application is submitted, and they are able to take action and move the case to the next step. Ash and the carrier will handle communication with the client. You can review the status by visiting your Ash Advisor Portal and clicking on the Cases tile on the homepage.

If your client does not qualify for accelerated underwriting, we will provide an alternate submission process for traditional underwriting. Your client will need to sign the application, which will be collected electronically at the client’s convenience.

An application for all of Ash’s carriers can be submitted through Ash Term Express.

Our top 20 life insurance carriers will be available to you in the Ash Quoter within the Ash Term Express platform. The platform will ask upfront questions to surface the best solutions for the client.

For New York clients only. All carriers can be quoted on the Ash Term Express platform. Ash Term Express applications for three NY carriers (AIG, Prudential and William Penn) with accelerated underwriting is available, if your client qualifies.