We give you solutions in a soundbite. These short videos will help you break down complex topics into ideas simple enough that you can start a piece of the conversation – with your clients or our team. Browse the library then contact us to go deeper on how to apply an insurance solution to your business.

Long-Term Care

Identifying Prospects for LTC - Business Owner Clients

In small businesses, everyone feels like family. Your most likely prospects will be business owners who have a vested interest in protecting their employees' future. They might not be as concerned about themselves, but long-term care can help owners retain and reward top talent.

|

2 minutes

|

Share Video

Long-Term Care

Identifying Prospects for LTC - High-Net-Worth Clients

The definition of “high-net-worth” can vary, but we’re generally looking at $2 million or more in investible assets. Although these clients are savvy enough to want to leverage the insurance company’s money, your conversation should center around protection, not cash.

|

2 minutes

|

Share Video

Long-Term Care

Finding the Funding for Long-Term Care

You can't put a price tag on peace of mind, but it's important to talk about how to fund it. If that plan includes a linked-benefit LTC solution, there are several ways to fund it, including idle assets, nonqualified annuities, qualified accounts and cash flow from other insurance policies.

|

2 minutes

|

Share Video

Long-Term Care

How to Approach Clients about Long-Term Care Planning

Nobody thinks they'll need long-term care. And we hope they're right. But that's where a long-term care planning conversation should begin. Watch to learn how three questions can effectively kick off the discussion and get clients out of the "it won't happen to me" mindset.

|

5 minutes

|

Share Video

Long-Term Care

Starting the Long-Term Care Conversation

See how the long-term care conversation is changing and learn three approaches you can use to get started. Remind clients that difficult planning topics are exactly why they chose to work with you. It may seem uncomfortable at first, but take it one step at a time.

|

2 minutes

|

Share Video

Long-Term Care

Overcoming Client Concerns - LTC is Expensive

Don’t think of an insurance solution as a cost. It’s another asset in your client's portfolio – one that gives them leverage by creating a larger pool of benefits. Today's long-term care solutions are highly flexible in both pricing and options, with riders or return-of-premium guarantees.

|

3 minutes

|

Share Video

Long-Term Care

Overcoming Client Concerns - LTC Planning is Overwhelming

When something is overwhelming, it's easier to ignore it and hope it doesn't come up again. That’s why your clients may avoid talking about long-term care. It's also why you need to get to the heart of their anxiety. What have they experienced and how can you help?

|

1 minutes

|

Share Video

Long-Term Care

Overcoming Client Concerns - LTC Planning Can Wait

If clients are asking for help because they need care, it’s too late. Without a plan in place, your only choice is to be reactive. Which is stressful for them and for you. By proactively planning early, clients ensure they are in a better position – financially, emotionally and logistically!

|

2 minutes

|

Share Video

Long-Term Care

Overcoming Client Concerns - Focused on Portfolio Growth

Retirement planning means saving AND protecting against the unexpected. Don’t let a focus on investing distract your clients from something that could wipe out all your hard work. While they are thinking about portfolio returns, you should also be talking about protecting their future.

|

2 minutes

|

Share Video

Long-Term Care

Overcoming Client Concerns - The 'M' Words

It’s time to talk about Medicare and Medicaid. Clients will often use these government programs as a default plan, but usually know little about them. If your client’s plan for long-term care is to spend their entire life savings, only to end up on welfare, then why plan for retirement?

|

2 minutes

|

Share Video

Long-Term Care

Overcoming Client Concerns - The Coverage Won't Pay

Let’s address the elephant in the room: the long-term care insurance industry has shifted in recent history. Your clients may have questions about what they’ve heard. But a properly structured policy, with today’s guarantees, can ensure coverage will last and work as planned.

|

1 minutes

|

Share Video

Long-Term Care

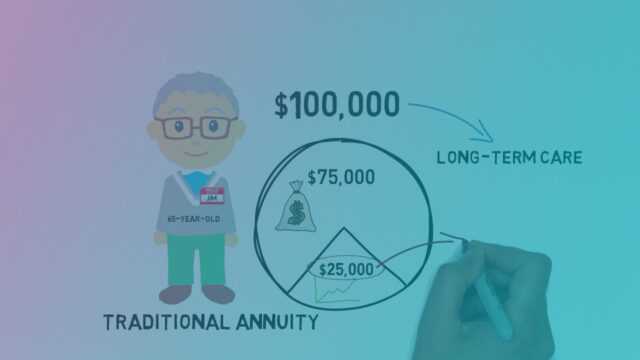

Asset-Based LTC Using Annuities

Thanks to the Pension Protection Act, an asset-based benefit annuity can turn idling funds into powerful coverage for long-term care. See why annuities are a great way to protect your clients' retirement portfolios AND provide a solution for LTC.

|

3 minutes

|

Share Video