We give you solutions in a soundbite. These short videos will help you break down complex topics into ideas simple enough that you can start a piece of the conversation – with your clients or our team. Browse the library then contact us to go deeper on how to apply an insurance solution to your business.

Technology & Innovation

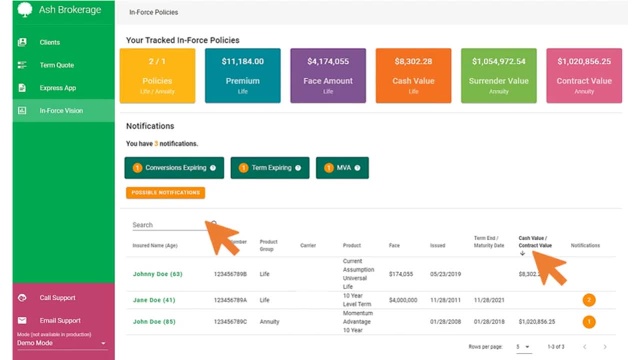

Introducing In-Force Vision

A better experience for managing your clients' in-force policies. With regular feeds from insurance carriers, you can be confident you are seeing the most up-to-date information and get policy changes such as a lapse or client death in a single dashboard.

|

3 minutes

|

Share Video

Life Insurance

Understanding Your Dashboard in Ash Express

With the Ash Term Express Digital Dashboard, you can easily manage your saved quotes and apps at a glance - even if you're not ready to submit. Plus, you can keep track of the apps you've already submitted and find opportunities.

|

3 minutes

|

Share Video

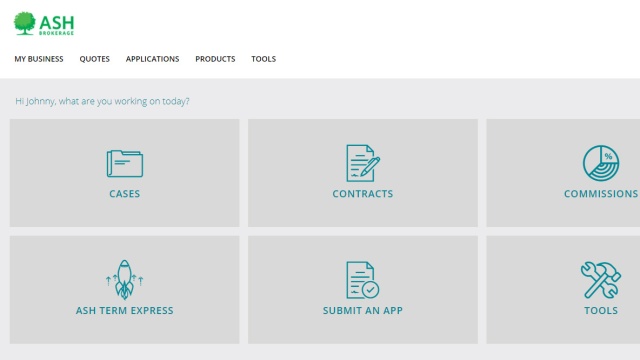

Navigating the Advisor Portal

Using the homepage titles and two navigation menus, you can get what you need – quickly.

|

2 minutes

|

Share Video

Let's Impact Lives Together

We're asking you to trust us with your clients — and we don't take that responsibility lightly. If you’re passionate about protecting your clients, impacting lives and growing your business, we should talk.

|

1 minutes

|

Share Video

Discovering Your Ash Team

There's no need to navigate everything on your own! See how your Ash team can help at each step along the way.

|

3 minutes

|

Share Video

Disability Insurance

Multi-Life Disability for Female Clients

Women pay more than men for disability insurance coverage. By purchasing coverage on multiple employees at once, female business owners can save money on their DI policies while adding critical income protection for their employees.

|

3 minutes

|

Share Video

Long-Term Care

Avoiding Unintentional Long-Term Care

Most people have intentional health insurance coverage. But, they also have an unintentional long-term healthcare plan. And that needs to change. Think of linked-benefit LTC as a cost-sharing approach with an insurance carrier as your partner.

|

3 minutes

|

Share Video

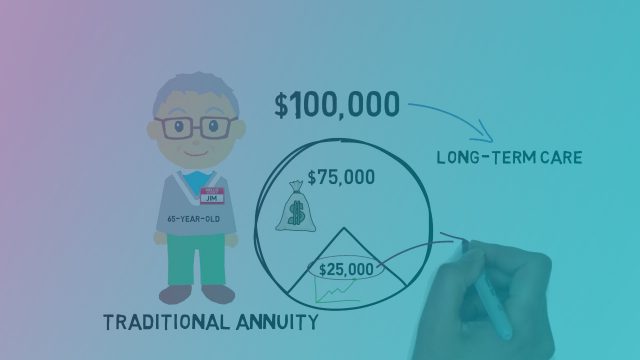

Long-Term Care

Asset-Based LTC Using Annuities

Thanks to the Pension Protection Act, an asset-based benefit annuity can turn idling funds into powerful coverage for long-term care. See why annuities are a great way to protect your clients' retirement portfolios AND provide a solution for LTC.

|

3 minutes

|

Share Video