We give you solutions in a soundbite. These short videos will help you break down complex topics into ideas simple enough that you can start a piece of the conversation – with your clients or our team. Browse the library then contact us to go deeper on how to apply an insurance solution to your business.

Retirement Solutions

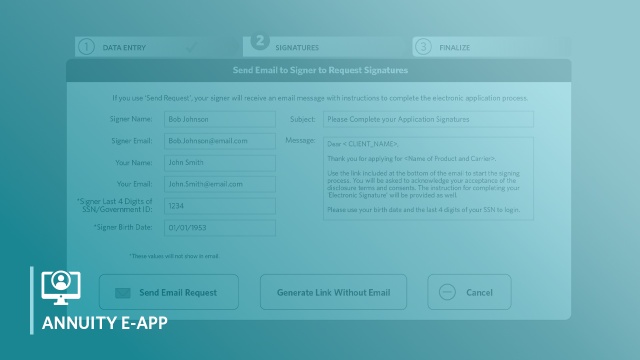

Collecting an Electronic Signature for an Annuity e-App

With an electronic annuity application, your client can complete the process digitally, with no paper or wet signatures needed. This tutorial walks you through how to access the Firelight platform inside Luma, to send an app for signing via email.

|

2 minutes

|

Share Video

Retirement Solutions

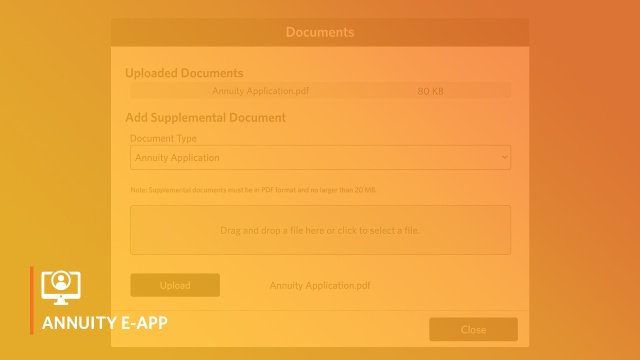

Collecting Wet Signatures for an Annuity e-App

With an electronic annuity application, you can still have your client sign with a wet signature. This tutorial shows you how to print a completed e-App form and upload the signed pages into the Luma platform for submission to a carrier.

|

3 minutes

|

Share Video

Retirement Solutions

Starting an Electronic Annuity Application

With an e-App, you can have your client sign electronically or print the application for them to sign — but everything will be in good order before submission.

|

3 minutes

|

Share Video

Long-Term Care

The Unseen Cost of Caregiving - Bryan's Story

The burden of providing care for aging parents usually falls on the sibling who lives closest. Hear from Bryan Langdon, Ash's national spokesperson for LTC, about his personal experience — and why clients should think hard about their plan.

|

7 minutes

|

Share Video

Life Insurance

Creating Family Harmony with Estate Equalization

Estate equalization isn't just about assets. It's about family, harmony, and legacy. Life insurance can create liquidity, so every child can be compensated equally without compromising cherished assets like a family business or vacation home.

|

2 minutes

|

Share Video

Advanced Planning

Make Charitable Giving Easier with Life Insurance

If you're working with philanthropic clients, life insurance can be an effective strategy to maximize giving. Whether naming a charity or purchasing a new policy, here's a quick overview of how clients can create a larger donation at a lower cost.

|

2 minutes

|

Share Video

Disability Insurance

What Top DI Agents are Saying About Ash Brokerage

With more than 250 paid DI cases, this group of agents knows what's important when discussing disability insurance. See how they use Ash Brokerage to find solutions — and why they keep coming back to the experts for income protection.

|

1 minutes

|

Share Video

Retirement Solutions

The Value of Pension Risk Transfer

With a single PRT solution, you get a triple win. Business owners get a risk off their books. Employees get stability for their defined benefit pension and security in their retirement plan. Advisors get a paycheck and a network of potential referrals.

|

2 minutes

|

Share Video

Life Insurance

Why Key Employees Need Benefit Restoration

While company-paid group life and disability insurance is beneficial, it is not equally valuable to each employee. Higher salaries can put key employees at a disadvantage. Restoration of benefits can make executives whole again.

|

2 minutes

|

Share Video

Long-Term Care

An Advisor's Story: How LTC PreView Increased Efficiency

Hear from your peer! Advisor Damon Strickland is no stranger to long-term care opportunities. But when he adopted Ash's LTC PreView prescreening tool into his process, efficiency followed. See why it helps get field underwriting right — right from the start.

|

11 minutes

|

Share Video

Long-Term Care

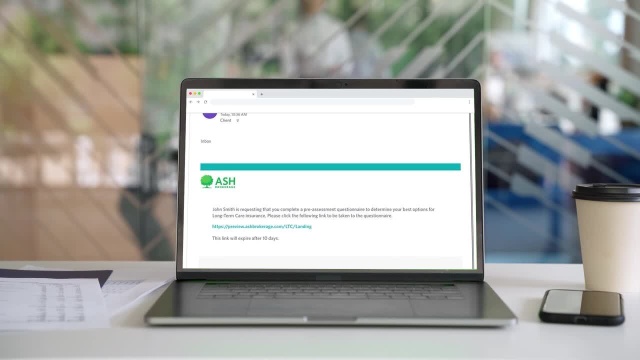

How To Use LTC PreView

See how to access our long-term care prescreening tool, LTC PreView, on the Ash Advisor Portal. You'll get a walkthrough of what clients will see and how you can use the platform to gather information, improve client experience and avoid unnecessary delays.

|

2 minutes

|

Share Video

Retirement Solutions

Bridging the Gap Between Early Retirement and Social Security

Delaying Social Security benefits can have significant financial advantages in the long run. For clients who want to retire early, annuities can serve as a powerful tool to bridge the income gap during the years you delay taking Social Security income.

|

3 minutes

|

Share Video