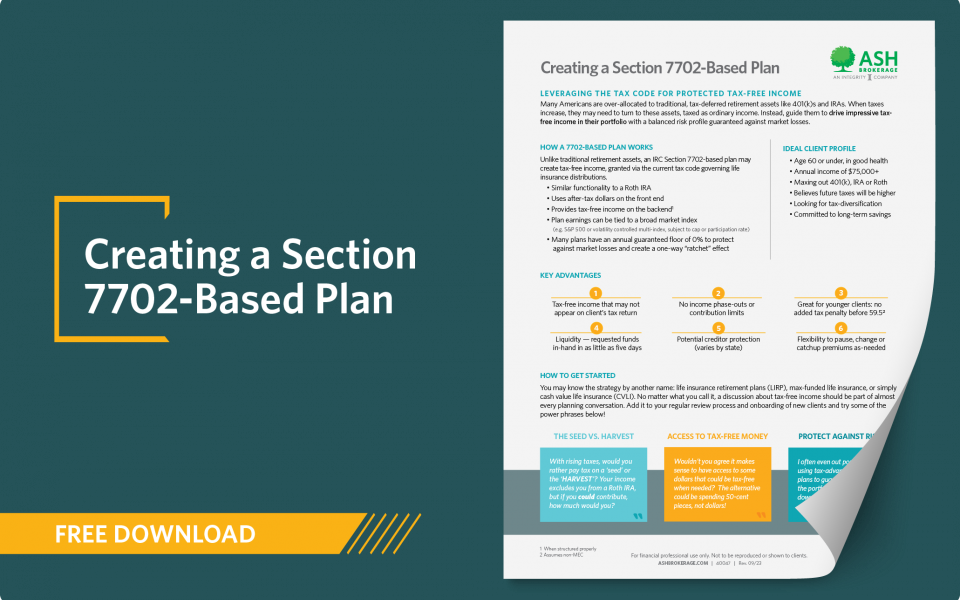

Many Americans are over-allocated to traditional, tax-deferred retirement assets like 401(k)s and IRAs. When taxes increase, they may be taxed as ordinary income. Guide them to tax-free income in their portfolio with a balanced risk profile guaranteed against market losses.

This piece is part of our foundation on how to leverage the benefits of cash value life insurance for tax-efficient income planning. If IRC Section 7702 rings a bell, it's because it is the tax code that allows life insurance retirement plans (LIRP) to have tax-free benefits. Some people even like to call it the insured retirement plan, since it is good at preventing losses from market downturns.