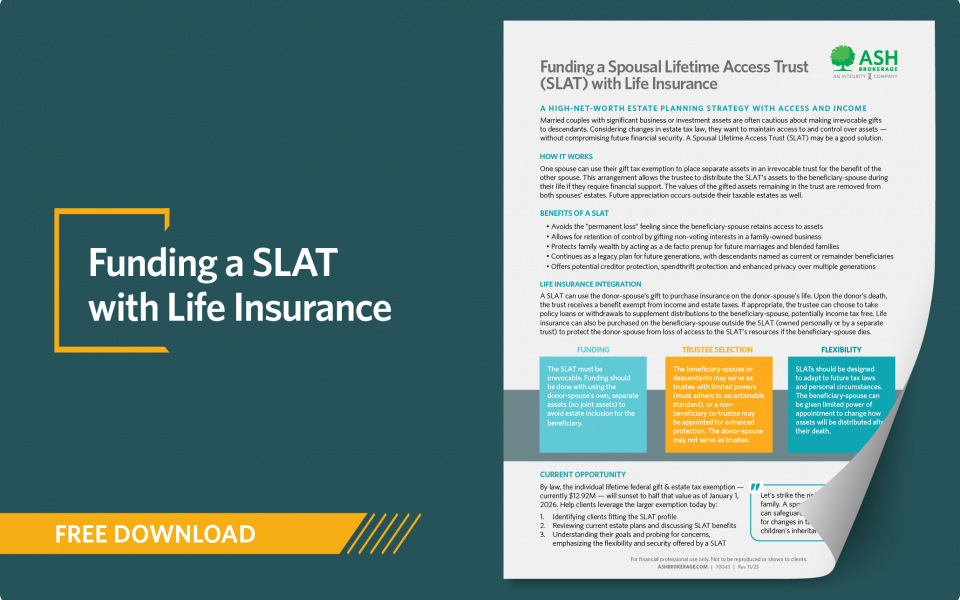

With a spousal lifetime access trust (SLAT), one spouse makes a gift to an irrevocable trust using the gift tax exemption. The SLAT names the other spouse as a current beneficiary, which allows the trustee to distribute funds to the beneficiary spouse during their life.