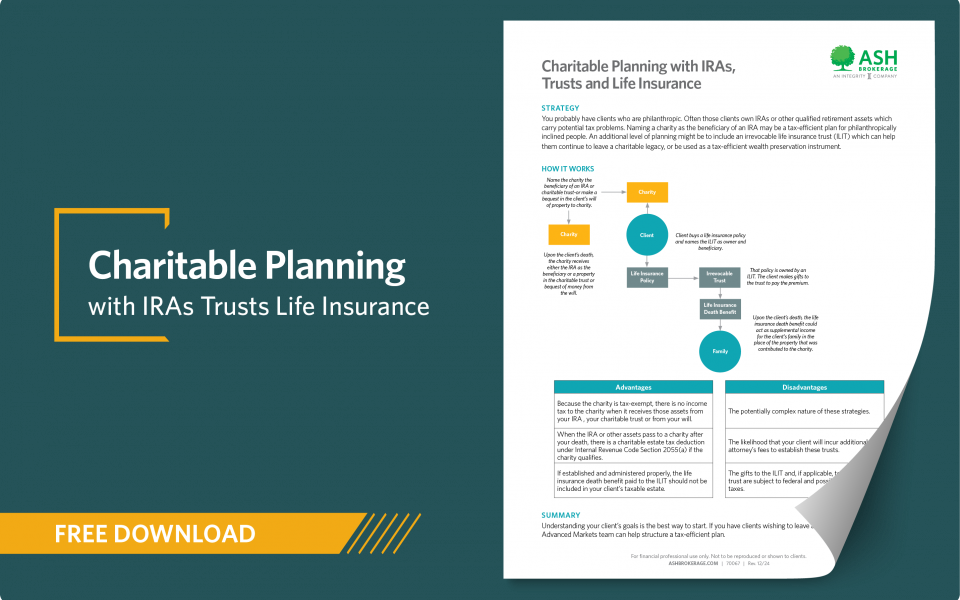

Clients who are philanthropic often own IRAs or other qualified retirement assets which carry potential tax problems. Naming a charity as the beneficiary of an IRA or including an irrevocable life insurance trust (ILIT) may provide a more tax-efficient wealth preservation plan.